Free Market Fever: The Deregulation Debate

Deregulation reduces government rules on business in the name of competition and efficiency.

The Dive

The roots of regulation in the United States trace back to the late 1800s, when the federal government created the Interstate Commerce Commission (ICC) in 1887 to regulate the railroad industry. At the time, railroads held monopolistic control over interstate commerce, setting unfair rates and exploiting farmers and small businesses. The ICC marked the beginning of a new idea: that the federal government could intervene in the economy to ensure fairness and prevent abuse by powerful private interests.

The 1930s brought a seismic shift. In response to the economic devastation of the Great Depression, President Franklin D. Roosevelt launched the New Deal, vastly expanding the federal regulatory state. Agencies like the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) were created to restore trust in banking and finance. The government stepped in not only to stabilize markets, but to guarantee basic protections for workers, consumers, and investors. Regulation became a tool for survival and rebuilding.

By the 1970s, however, confidence in regulation had started to erode. Critics argued that some agencies were no longer protecting the public but had become too cozy with the industries they were meant to oversee—a phenomenon known as 'regulatory capture.' Economists and legal scholars across the political spectrum began to question whether heavy-handed regulations were stifling innovation, propping up monopolies, and driving up costs for consumers.

The momentum for deregulation took hold in the late 1970s under President Jimmy Carter, who supported the removal of outdated rules in sectors like airlines and trucking. This movement crossed party lines. In 1978, the Airline Deregulation Act dismantled government control over fares, routes, and market entry for commercial airlines, leading to increased competition and lower ticket prices—but also consolidation and labor disputes.

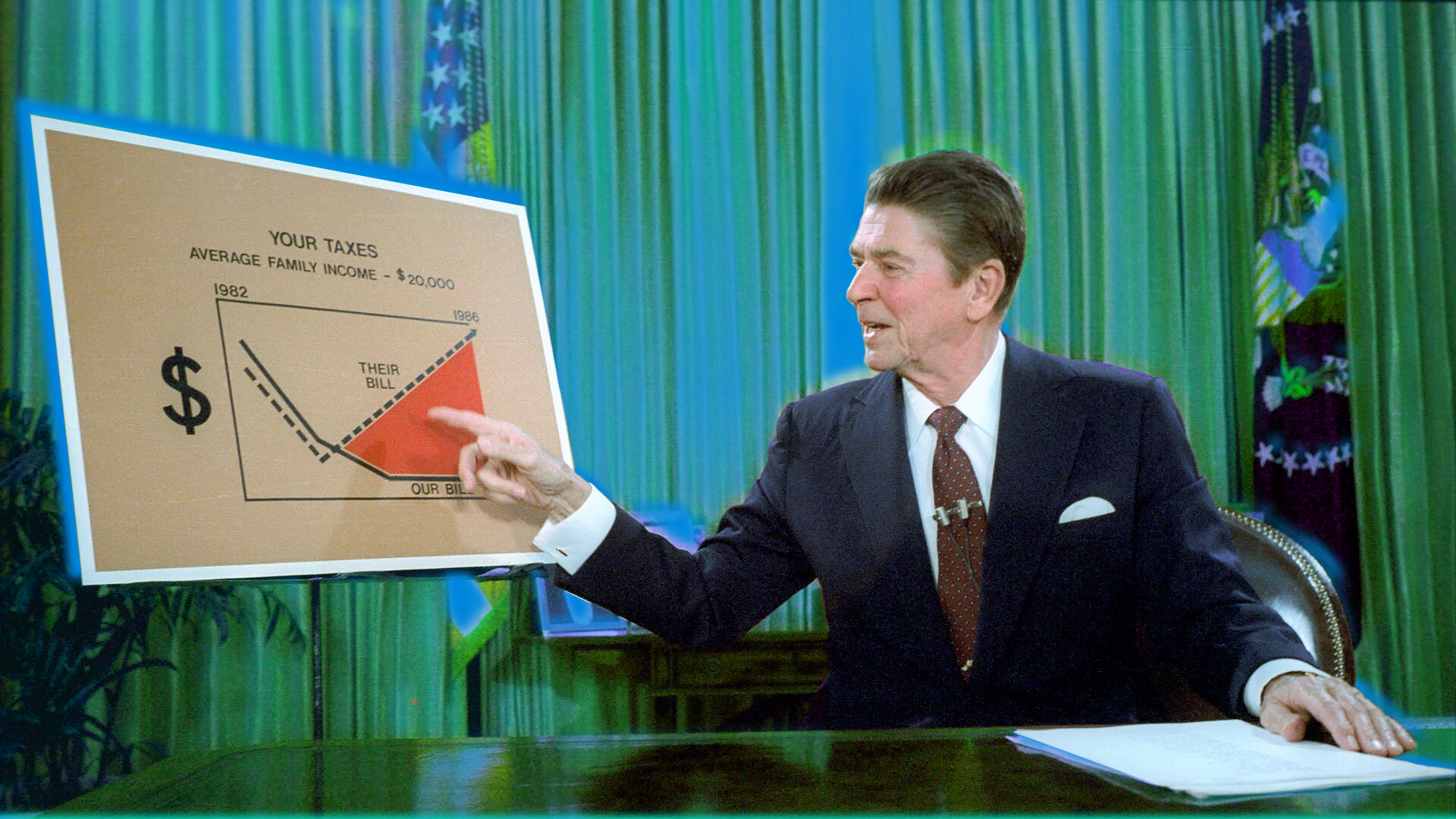

Ronald Reagan rode the deregulation wave into the White House in 1981, embedding it in his economic philosophy. Reagan argued that overregulation was strangling American business and productivity. He appointed officials who were openly hostile to regulation, like James Watt at the Department of the Interior and Anne Gorsuch at the Environmental Protection Agency, who worked to scale back enforcement and restructure their agencies in favor of industry interests. While Reagan preserved some social regulations, his administration viewed economic regulations as obstacles to growth.

The 1980s also saw deregulation in telecommunications, with the breakup of AT&T in 1984 marking a turning point in how Americans accessed phone service and, eventually, the internet. Proponents celebrated this as a victory for consumer choice and technological advancement. But not all deregulation led to progress. In banking and finance, the loosening of rules in the 1980s and 1990s enabled risky behavior that culminated in the savings and loan crisis and later contributed to the 2008 financial collapse.

The financial deregulation of the 1990s and early 2000s — especially the repeal of the Glass-Steagall Act, which had separated commercial and investment banking — allowed Wall Street firms to grow into 'too big to fail' institutions. When the housing bubble burst and the global economy crashed in 2008, critics pointed to deregulation as a key factor in the meltdown. The crisis reignited public debate about whether markets could be trusted to police themselves.

In 2017, President Donald Trump introduced a bold new regulatory rollback strategy with Executive Order 13,771, which mandated that for every new regulation issued, two must be eliminated. His administration emphasized cutting compliance costs for businesses and minimizing federal intervention. While some industries praised the rollback, critics warned it prioritized short-term profits over long-term public health, worker safety, and environmental stability.

At its core, the debate over deregulation reveals a deep ideological divide in American political life. Supporters argue that regulation slows growth and limits individual freedom, while opponents contend that without guardrails, the powerful will exploit the weak, and profit will trump people and the planet. The question remains: Who should shape the rules of the game, elected governments accountable to the public, or markets driven by profit?

Why It Matters

Deregulation isn’t just about rules, it’s about power. Who gets to set the boundaries of business? Who pays the price when profit is prioritized over people or the planet? From airline seats to Wall Street risk, deregulation has shaped everyday life and left behind big questions: What is freedom without accountability? And what is growth if it’s built on collapse?

?

How has deregulation affected consumer safety and environmental protections?

What were the economic consequences of deregulating industries like banking and telecommunications?

Why do some leaders see government regulation as a threat to freedom?

Should certain industries always be regulated? Why or why not?

Dig Deeper

This explainer from CNBC breaks down how deregulation shaped American industries—from airlines to finance—and why the debate continues today.

PBS explores Reagan’s approach to cutting regulations and how it changed the role of government in American life.

Related

The Conservative Resurgence and Economic Shifts

How a political swing to the right reshaped America’s economy, culture, and political identity in the late 20th century.

The New Deal: Fighting Depression with Bold Ideas

Faced with economic collapse, President Franklin D. Roosevelt launched a revolutionary plan to rebuild America from the ground up. The New Deal wasn’t just policy—it was a bold experiment in hope, action, and government responsibility.

The Great Society: Government as a Force for Good

The Great Society wasn’t just a policy agenda, it was a radical vision of what America could be. With sweeping reforms in health care, education, civil rights, immigration, and the environment, President Johnson’s plan aimed to eliminate poverty and racial injustice once and for all.

Further Reading

Stay curious!