Trickle-Down Economics

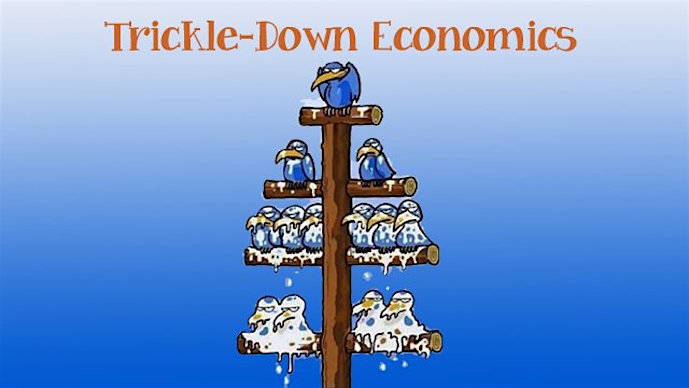

Trickle-down economics is the idea that tax cuts and financial breaks for the wealthy and corporations will eventually benefit lower-income individuals by spurring investment and economic growth.

The Dive

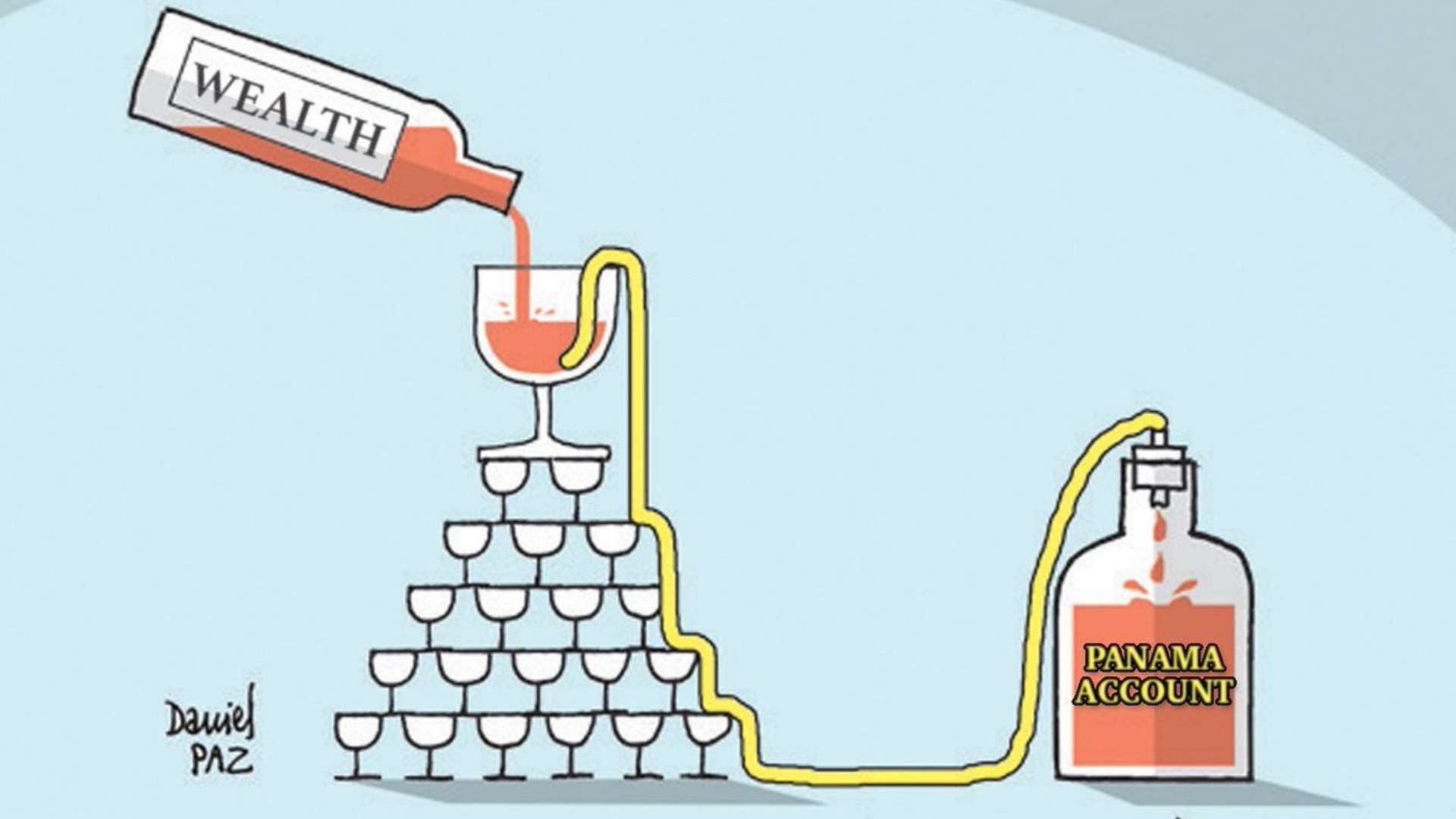

The term 'trickle-down economics' became widely known during the Reagan administration in the 1980s, but the idea dates back much further. The theory suggests that lowering taxes on corporations and wealthy individuals will lead to increased investment, job creation, and overall economic growth—eventually benefiting everyone. But history tells a different story.

Economists have spent years analyzing the impact of trickle-down policies, and the results aren’t great. A 2020 study by economists David Hope and Julian Limberg looked at 50 years of data from 18 countries and found that tax cuts for the rich did not lead to economic growth or job creation. Instead, they simply made the wealthy wealthier.

The 2017 Trump tax cuts followed the same pattern. While corporations and the ultra-rich saw massive reductions in their tax rates, everyday Americans saw little to no benefit. In fact, from 2017 to 2023, American billionaires saw their wealth increase by $2.2 trillion, while wages for working people barely budged. The promise of higher wages, more jobs, and economic expansion never materialized.

Meanwhile, these tax cuts came at a steep cost: rising national debt, cuts to public programs like healthcare and education, and increasing inequality. When tax revenues shrink due to cuts for the rich, governments often compensate by slashing spending on social programs that support low- and middle-income families.

In contrast, policies that put money directly into the hands of working-class and middle-class families—like expanding the Child Tax Credit or investing in affordable housing—have been shown to stimulate the economy far more effectively. Nobel Prize-winning economist Joseph Stiglitz calls this 'trickle-up economics,' where economic growth happens when the majority of people have money to spend, not just the elite few.

Despite mounting evidence against trickle-down policies, they remain a popular talking point among politicians advocating for tax cuts on corporations and billionaires. As the debate continues, it's worth asking: Who actually benefits from these policies, and who is left paying the price?

Why It Matters

Economic policies shape our everyday lives, from the price of groceries to the availability of good jobs. When the wealthy and corporations get massive tax breaks while working-class Americans see little to no benefit, it raises serious questions about fairness and economic justice. If decades of evidence show that trickle-down economics doesn’t work, why do some politicians keep pushing for it? Understanding the reality behind these policies helps us demand a tax system that works for everyone—not just the ultra-rich.

?

Why do you think some politicians continue to support trickle-down economics despite evidence that it doesn’t work?

How do tax cuts for billionaires affect government services like healthcare and education?

What’s the difference between trickle-down economics and ‘trickle-up’ economics?

How can tax policy shape economic opportunities for future generations?

What economic policies might actually reduce income inequality?

Dig Deeper

Dig into trickle-down economics, which claims that tax cuts for corporations and the wealthy stimulate the economy and improve people's lives.

Robert Reich debunks 12 misconceptions about tax policy in America.

Related

Wealth Inequality

Wealth inequality in the United States has grown to levels that threaten the stability of the social and economic systems. How does this imbalance affect society as a whole, and what can be done to address it?

The Gilded Age, Industrialization, and the 'New South'

A glittering era of innovation and industry, the Gilded Age promised progress but delivered inequality. In the South, leaders dreamed of a 'New South,' yet industrialization offered opportunity for some while reinforcing systems of poverty and discrimination for others.

MLK the Disrupter and the Poor People’s Campaign

Dr. Martin Luther King Jr.’s final chapter was about more than civil rights—it was a bold demand for economic justice that challenged the nation’s values at their core.

Further Reading

Stay curious!