The Legal Tender Act: The Birth of Greenbacks

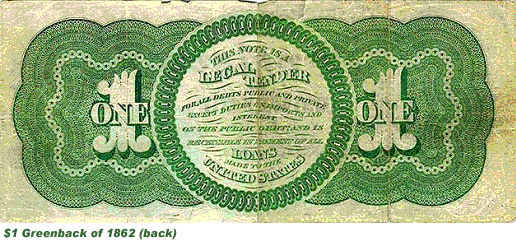

A historic U.S. greenback note, the first federally issued paper currency, introduced during the Civil War.

What Happened?

Before the Legal Tender Act, the U.S. government operated on a hard money system, using gold and silver as the primary forms of currency. This meant that every paper note issued was backed by precious metals, ensuring its value.

However, by 1862, as the Civil War raged on, the Union government was running out of gold and silver reserves. To keep paying soldiers, buying weapons, and funding war efforts, Congress made a drastic decision—it authorized the printing of paper money that was not backed by gold or silver. These new notes, called greenbacks due to their distinctive color, were declared legal tender, meaning they had to be accepted for debts, taxes, and public payments.

Critics feared disaster. Many bankers and economists warned that without a gold or silver guarantee, greenbacks would become worthless, leading to runaway inflation and a collapsed economy. Even members of Congress were skeptical, worried about the long-term consequences of relying on paper money.

Despite the doubts, greenbacks worked. The new currency allowed the Union government to keep the war effort going. By putting more money into circulation, commerce in the North remained active, businesses could continue operating, and the Union army could keep fighting. Congress also introduced income and excise taxes to help control inflation and stabilize the economy.

Over the next few years, more legal tender acts were passed, and by the end of the war, nearly $500 million in greenbacks had been printed. This experiment in fiat currency—money not backed by physical commodities—proved successful enough that it laid the foundation for a national currency system in the years that followed.

However, the Legal Tender Act remained controversial. After the war, as the economy recovered, some pushed to return to a gold-backed currency, while others supported maintaining paper money. The debate even reached the Supreme Court in 1870, where the Legal Tender Act was initially ruled unconstitutional. Ironically, the Chief Justice who wrote the ruling was none other than Salmon Chase—the former Treasury Secretary who had championed the greenbacks. But just one year later, President Ulysses S. Grant appointed new justices, and the Court reversed its decision, upholding the act in a landmark 5-4 ruling.

Ultimately, the Legal Tender Act set a precedent for future monetary policy. By 1971, the U.S. officially abandoned the gold standard, making all American currency fiat money, just like the first greenbacks of the Civil War.

Why It Matters

The Legal Tender Act marked a seismic shift in how money worked in the United States. By introducing paper money that wasn’t backed by gold or silver, the government was able to fund the Civil War, but it also set the stage for a future where money was based on trust rather than tangible assets. Fast forward to today, and the debate over what gives money its value is more relevant than ever. As digital payments rise and cash transactions decline, some argue that a cashless society is the inevitable next step. But is that truly in the public’s best interest? Who benefits when physical money disappears, and what happens to those left behind in the transition? The push for a cashless world is often framed as progress—faster, more efficient, and more secure. But history has shown that financial decisions made in times of crisis can have long-term consequences. Just as the Legal Tender Act gave the government new powers over money, a fully cashless system could concentrate financial control in the hands of banks, payment processors, and governments. The story of greenbacks reminds us that money is more than just paper or numbers on a screen—it’s a system built on trust. Understanding its history helps us ask better questions about the future: Who controls our money? Who benefits from change? And most importantly, how do we ensure financial systems serve everyone, not just the powerful?

?

Why was the introduction of greenbacks considered such a controversial financial move?

How did the Legal Tender Act contribute to the Union’s ability to win the Civil War?

What were the long-term effects of the Legal Tender Act on U.S. monetary policy?

How did the Supreme Court's ruling on the Legal Tender Act change over time?

Dig Deeper

The Civil War sparked a sea change in US history. The entire nation, including its financial system, was transformed. Old problems are solved and new ones are created as Treasury Secretary Salmon Chase struggles to provide the money President Lincoln needs to deal with the rebellion.

Related

Federalists vs. Anti-Federalists: The Battle That Built the Constitution

One side feared chaos. The other feared tyranny. Together, they gave us the Constitution—and the Bill of Rights.

The American Civil War – A Nation Torn Apart

From Fort Sumter to Appomattox, the Civil War was the deadliest conflict in U.S. history, fought over the nation's most profound moral and political divisions.

The Cape Fear & Waccamaw Siouan: Indigenous History of Southeast North Carolina

Long before the first European ships arrived at the Carolina coast, the Cape Fear River and Lake Waccamaw were home to thriving Indigenous communities.

Further Reading

Stay curious!