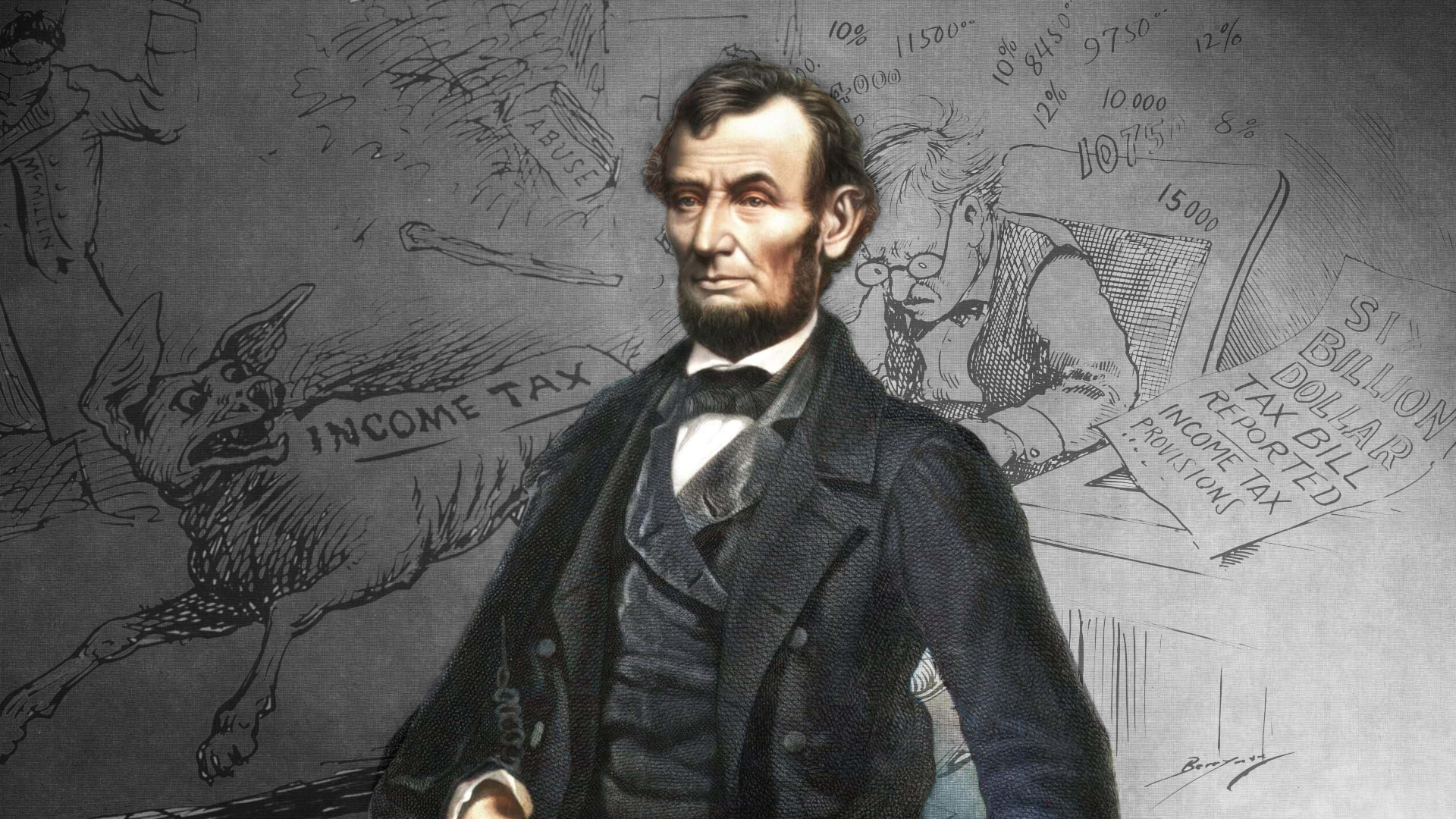

Lincoln Signs the First Federal Income Tax: Paying for a Nation at War

Abraham Lincoln signs the Revenue Act of 1861, marking the start of federal income tax in the U.S.

What Happened?

Abraham Lincoln wasn’t just battling secession—he was battling subtraction. The Civil War was draining federal resources fast, and the question wasn’t just how to win, but how to pay for it. So Lincoln did something revolutionary: he taxed income.

The Revenue Act of 1861 imposed a 3% tax on annual incomes over $800 (about $18,000 today). It also taxed imports and property, marking the first time the federal government directly asked citizens for a cut of their earnings.

But Lincoln didn’t just sign the bill and hope for the best. He had asked his Cabinet whether such a tax was even constitutional. Their consensus? Since it didn’t target property directly, it was an 'indirect tax'—perfectly legal under Article I of the Constitution. No amendment required. Crisis, meet creativity.

There was just one problem: collecting the tax proved almost impossible. There was no centralized tax agency, and only about 3% of the North’s population earned enough to qualify. So in 1862, Congress went further—creating the Office of the Commissioner of Internal Revenue and rolling out the first progressive tax brackets. Welcome to the proto-IRS.

Lincoln’s tax experiment ended in 1872, but the idea stuck. After more legal battles (and a Supreme Court smackdown in 1895), Congress passed the 16th Amendment in 1909. By 1913, the modern income tax system was born—for better, for worse, and for infrastructure.

So if you’ve ever groaned at tax season, blame history—and thank it too. From bridges to schools to defense, taxes fund the public goods we share. Lincoln didn’t just preserve the Union with guns and speeches—he did it with math.

Why It Matters

The Civil War wasn’t just fought with bullets—it was financed with bold ideas. Lincoln’s first income tax may have been flawed, but it planted the seeds for a system of shared responsibility. Today, federal income tax is a major tool for funding roads, parks, research, healthcare, and national security. It’s easy to grumble about taxes—but when democracy needs defending or bridges need building, that money means power, protection, and potential.

?

Why did Lincoln believe an income tax was necessary during the Civil War?

What’s the difference between a direct tax and an indirect tax under the Constitution?

How did the Revenue Act of 1862 improve on the original 1861 law?

What types of public goods and services are funded by income tax today?

Why was the 16th Amendment necessary to make income tax permanent and legal?

Do you think income taxes are a fair way to fund government services? Why or why not?

Dig Deeper

So, what are taxes? Why do we pay taxes? What is all that tax money used for? This video covers all that and more. Types of taxes, progressive and regressive taxes, tax brackets, and even get into a few historical scenarios where bad tax policy led to revolutions.

Related

Indian Removal and the Trail of Tears

In the 1830s, the U.S. government forced thousands of Native Americans—including the Cherokee—off their ancestral lands, leading to a deadly westward march known as the Trail of Tears.

The Bill of Rights: What Is It and What Does It Actually Do?

The Bill of Rights wasn’t added to the Constitution because everything was going great, it was added because the people didn’t trust the government. And they had every reason not to.

From Articles to the Constitution

The Articles of Confederation got us through a revolution—but not much more. Weak laws, no executive, and constant in-fighting forced the Founders back to the drawing board. What came next? The Constitution.

Further Reading

Stay curious!