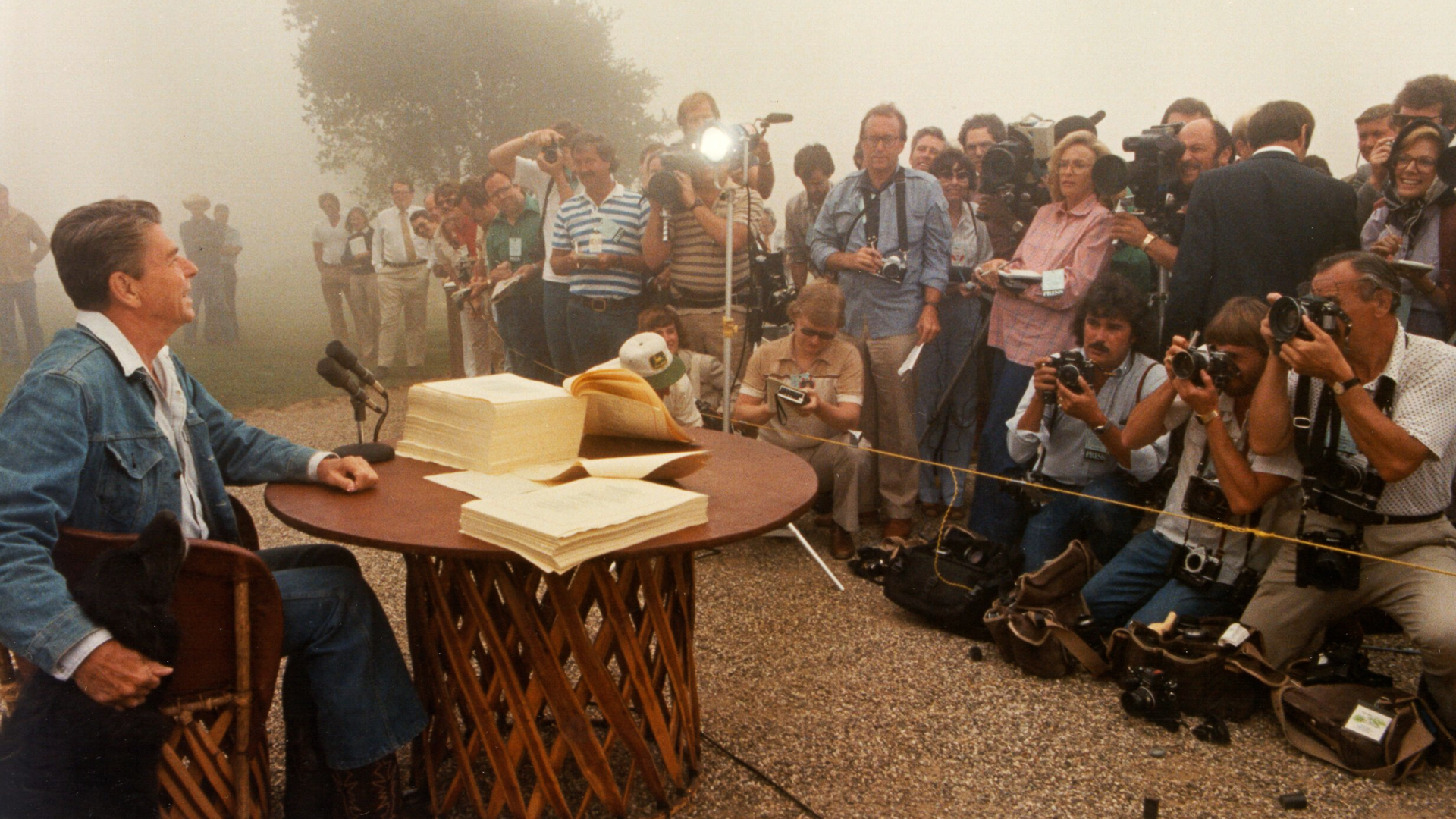

Reagan Signs the Economic Recovery Tax Act

President Ronald Reagan signing the Economic Recovery Tax Act at Rancho del Cielo

What Happened?

Ronald Reagan didn’t sign the Economic Recovery Tax Act (ERTA) in Washington. He signed it at Rancho del Cielo—his private California retreat—marking it as both a personal and political milestone.

ERTA embodied Reagan’s campaign promise of supply-side economics: cut taxes for individuals and businesses to encourage production, innovation, and risk-taking. The theory was that if producers had more capital, they’d expand, hire, and create a rising tide for all.

The legislation delivered a 25% across-the-board cut in individual tax rates, phased in over three years, and indexed rates to inflation. For the highest earners, the top marginal rate fell from 70% to 50%. Businesses gained faster depreciation schedules to encourage investment.

Its champions—Representative Jack Kemp and Senator Bill Roth—framed ERTA as an engine for growth. And in some ways, it worked: venture capital surged, the personal computer revolution gained steam, and GDP rose throughout the mid-1980s.

But there was a price. Federal revenues dropped sharply while spending remained high, leading to record budget deficits. Between 1982 and 1989, the national debt nearly tripled, climbing from $1.1 trillion to $2.9 trillion.

The law also marked a turning point in Republican fiscal philosophy. Balanced budgets took a back seat to tax cuts as the party’s economic rallying cry—a shift that would shape budget battles for decades.

Supporters point to ERTA as a catalyst for the 1980s economic expansion and America’s tech boom. Critics argue it widened income inequality and entrenched a political pattern of cutting taxes without matching spending cuts.

Either way, ERTA wasn’t just a policy shift—it was a declaration. The federal government would be smaller in scope, the private sector bigger in ambition, and the long-term consequences would ripple far beyond Reagan’s two terms.

Why It Matters

ERTA redefined the relationship between taxation, economic growth, and government responsibility in America. It cemented supply-side economics in Republican policy, influenced decades of tax debates, and left an enduring question: can a nation cut its way to prosperity without cutting what it spends?

?

What is supply-side economics, and how does it differ from demand-side approaches?

How did ERTA influence the economic boom and bust cycles of the 1980s and 1990s?

What role did ERTA play in the growth of the national debt?

How did ERTA affect income inequality in the United States?

In what ways did ERTA influence future U.S. tax policy and political priorities?

Dig Deeper

Learn about President Ronald Reagan's economic policies, known as Reaganomics, and why their trickle-down theory remains a subject of heated debate.

Dig into trickle-down economics, the theory behind supply-side policies like ERTA, and the evidence for and against its claims.

Related

The Emancipation Proclamation & The 13th Amendment

Freedom on paper is one thing; freedom in practice is another. The Emancipation Proclamation and the 13th Amendment were giant leaps toward liberty—yet the road ahead for formerly enslaved people was long and uneven.

Fascism: Power, Propaganda, and the Fall of Democracy

Fascism emerged from the ruins of World War I and found its foothold in fear, nationalism, and economic despair. It promised unity, but delivered control, conformity, and catastrophe.

The Louisiana Purchase: A River, A Bargain, and a Bigger United States

In 1803 the United States bought the vast Louisiana Territory from France, doubling the nation’s size, securing the Mississippi River, and setting the stage for westward expansion and hard questions about slavery and Native sovereignty.

Further Reading

Stay curious!