Black Thursday: The Start of the Great Depression

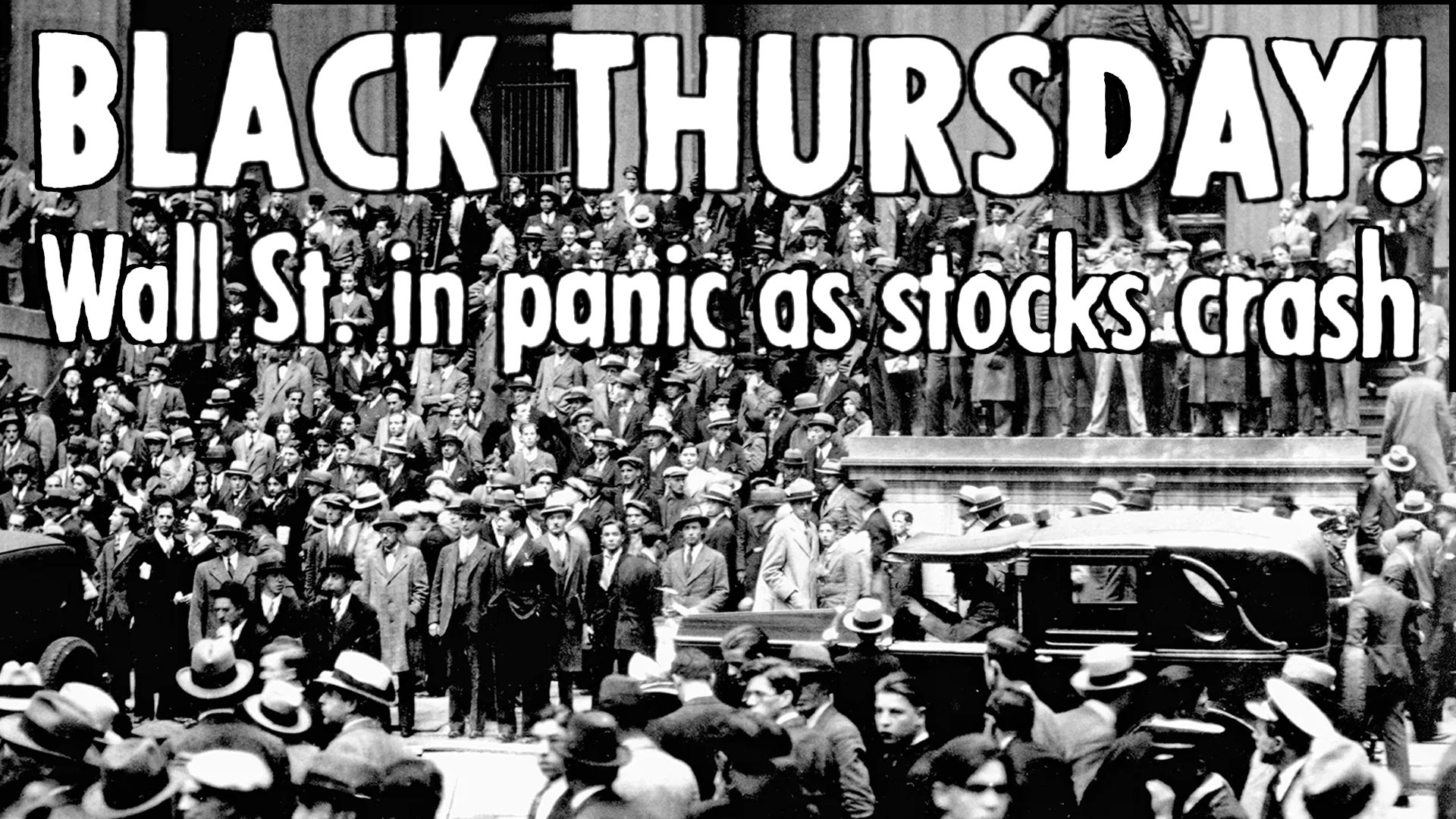

Crowds of worried investors gather outside the New York Stock Exchange on Black Thursday, October 24, 1929.

What Happened?

Throughout the 1920s, Americans were caught up in a wave of optimism. The economy was booming, new inventions like radios and cars were transforming everyday life, and the stock market seemed to promise wealth for anyone willing to invest. Ordinary people like teachers, factory workers, and even maids bought stocks, often using borrowed money. This practice, called 'buying on margin,' meant they only had to pay a small part of the stock’s price up front and borrowed the rest from brokers.

By the summer of 1929, this system had spun out of control. Stock prices had climbed far higher than the real value of companies. Many people assumed prices would keep rising forever, but some economists began warning that a crash was coming. In September, the market started to wobble. Newspapers ran alarming headlines, and anxious investors began selling their stocks.

On the morning of October 24, 1929, fear turned to panic. Even before the New York Stock Exchange opened, thousands of investors tried to sell their shares all at once. By midday, more than 12 million shares had been traded, three times the usual amount, and prices were falling so fast that stock tickers couldn’t keep up. Crowds gathered outside the Exchange, watching as years of fortune vanished in hours.

A group of powerful bankers, including J.P. Morgan, tried to calm the panic by buying large amounts of stock to show confidence in the market. Their efforts helped prices rise slightly by the end of the day, but the damage was done. The next Monday and Tuesday, the panic returned with full force. By October 29, Black Tuesday, the market had lost almost 90% of its value compared to its high just weeks earlier.

The crash didn’t cause the Great Depression overnight, but it triggered a chain reaction that exposed deep weaknesses in the U.S. economy. Banks that had invested in the market failed, taking people’s savings with them. Businesses laid off workers, farms went bankrupt, and families across the country struggled to survive. Within a few years, one in four Americans was unemployed.

In response to the disaster, the government eventually created new laws to make the financial system safer. The Federal Deposit Insurance Corporation (FDIC) was founded to protect people’s bank savings, and the Securities and Exchange Commission (SEC) was established to prevent the kind of reckless speculation that led to the crash. These reforms were part of President Franklin D. Roosevelt’s New Deal in the 1930s.

The crash of 1929 became a turning point in American history, a lesson in how greed, debt, and overconfidence can destabilize an entire economy. It showed that financial systems depend not only on numbers but also on trust, fairness, and regulation. When those break down, everyone pays the price.

Even though the market eventually recovered, it took 25 years, until 1954, for the Dow Jones Industrial Average to return to its pre-crash level. For those who lived through the Great Depression, the memory of Black Thursday remained a powerful reminder that economic growth must be built on real stability, not speculation.

Why It Matters

Black Thursday marked the beginning of a decade of hardship that reshaped America’s economy and government. It revealed how dangerous unchecked speculation can be and led to major reforms designed to protect workers, investors, and families. The lessons from 1929 continue to remind us that financial systems require both freedom and responsibility, and that true prosperity depends on stability, not risk-taking.

?

Why did so many people in the 1920s believe the stock market would keep rising forever?

What does it mean to 'buy on margin,' and why was it risky?

How did the stock market crash affect ordinary Americans, not just investors?

What changes did the government make after the crash to protect people’s money?

How did the Great Depression change the way Americans thought about the economy?

Dig Deeper

A look at how risky speculation, easy credit, and panic selling led to the biggest financial crash in American history.

How the 1929 crash led to the Great Depression—and what the U.S. government did to rebuild confidence and stability.

Related

The Great Depression: America in Crisis

The Great Depression was more than a stock market crash — it was a decade-long test of American resilience that reshaped the nation's economy, politics, and daily life.

The New Deal: Fighting Depression with Bold Ideas

Faced with economic collapse, President Franklin D. Roosevelt launched a revolutionary plan to rebuild America from the ground up. The New Deal wasn’t just policy—it was a bold experiment in hope, action, and government responsibility.

The Dust Bowl and the Price of Plowed Dreams

On May 11, 1934, a dust storm two miles high turned daylight into darkness and carried America’s soil into the Atlantic Ocean. But this wasn’t just a weather event—it was the collapse of a dangerous illusion.

Further Reading

Stay curious!